PC

PC Mobile device

Mobile deviceInformation

English (United States)

Description

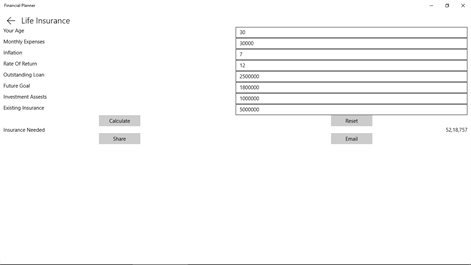

The Financial Calculator helps you to plan for your long-term financial goals like Child Education, Child Marriage, Retirement Plan.

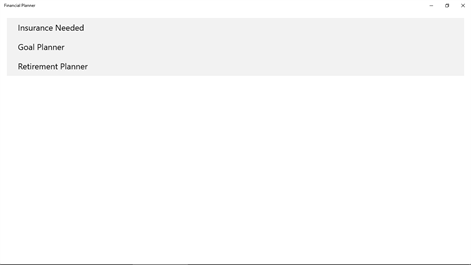

Features - Insurance Needed - Goal Planner. - Retirement Planner.

1. Goal Planner Goal Planner will help you to plan for any financial goals like Child Education or Child Marriage. It calculates the monthly investment required for achieving the goal. You can give the goal present value, No of Years remain, Inflation, rate of returns on your investments.

Example: Suppose you want to plan for your Child education which costs 8, 00,000 today. The Number of Years remain is 15 years and the inflation you expect is 7% and you expect 12% return from your investments. In that case future value is 22, 07,225 and to achieve that future value you need to invest 4,418 per month or lump sum invest 4, 03,252.

2. Retirement Planner Retirement Planner helps you determine how much money you will need for your retirement to maintain the current lifestyle post retirement. You can give the Current Age, Retirement Age, Current Monthly Expenses, Expected Inflation, rate of returns on your investments before retirement and rate of returns on your investments after retirement.

Example: Suppose you are 30 years old who wants to retire at 58 and expect to live till 80. If your current Monthly Household Expenses (excluding expenses which will not be part of it post Retirement e.g. EMI, Insurance Premium, Education Expenses etc) are 30000, You expect inflation to be around 7% for next 28 years, You expect 15% return on your investments before retirement and During retirement you expect that your investments will return 10%. So Number of Years left for your retirement are 28 years and at retirement you will require a retirement corpus of 3,99,98,159 for which I need to save 7,719 per month.